After weeks of speculation the Ontario Government has finally decided to step forward and introduce new measures to help try and cool the GTA’s white hot housing market.

The Fair Housing Plan was revealed last Thursday ahead of schedule. The 16 Point Plan includes a 15 per cent tax on foreign buyers, expanded rent control rules and actions to increase housing supply. Here’s a quick breakdown of the main measures.

Rent Control – Expanding rent control to all private rental units in Ontario, including those built after 1991. Landlords will have their annual increase capped at a maximum of 2.5 % as opposed to previously being able to increase rents without a cap on any rentals built after 1991.

This is by far the most controversial of all the changes. Many argue higher rents are a part of living in a big city and it should be left alone, others feel some greedy landlords keep pushing up rents year over year. With higher than ever home prices rental demand is high and Toronto has less inventory in apartment rentals than most mega cities, adding rent control to landlords will not entice them to build more apartments. In the short term it will be beneficial to renters but history has shown that tight rent control usually means developers will build less inventory which in turn will mean higher rents in the future.

15-per-cent Non-Resident Speculation Tax (NRST) – Similar to Vancouver’s Foreign Buyers Tax except Ontario’s has many more exclusions questioning the long term affect it will have. Refugees would not be subject to the NRST and a rebate would be available for those who attain citizenship or permanent resident status as a well as foreign nationals working in Ontario and international students.

Increase Housing Supply – Ontario is setting up a Housing Supply Team to study measures to increase the building of new homes & condos. The province will also look to put in new incentives for developers that build rental apartment buildings and finally they will introduce legislation to allow Toronto to introduce a vacant home tax.

Summary

While I applaud the government for trying to reign in the real estate market they failed to address one of the main problems, domestic speculators. As a real estate agent I run into people asking advice on investment properties on a weekly basis. Its become the new stock market for many and that is not what the housing market should be used for. Sooner or later this needs to be addressed.

The rent control measures may backfire in the long-run unless they implement big incentives for developers to build more rental apartments. They have said they plan to do this but only time will tell. Supply of rentals will not change in the short term so prices will remain high as long as the demand is there.

The foreign buyers tax is technically still open to international investors sending their children to study here and that number is fairly substantial. With all the loopholes available I feel like the government was too scared to take a more hardline stand on this issue but felt they needed to do something to appease the masses.

Increasing housing supply is obviously important and its a step in the right direction but this will take many years to do, thus it will not affect the current market, it should however improve it in the years to come.

The Bottom Line

The Bottom Line

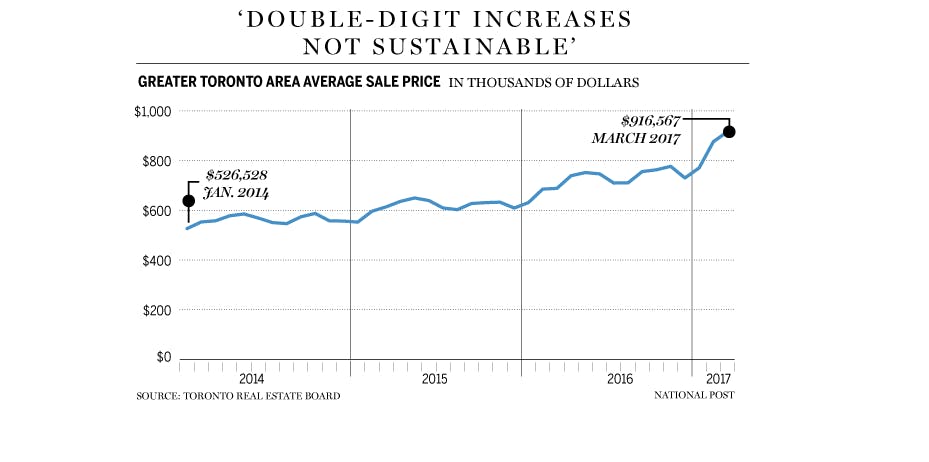

When BC put in their Foreign Buyers Tax back in the Summer of 2016 the market took a sharp downturn and slowed immediately. Prices went from a soaring 40% appreciation year over year to a somewhat more reasonable 15% appreciation. This lasted for all of about 8 months. We have now seen a significant upswing in the recent week with Vancouver prices increasing quickly again.

Toronto could also see similar results with buyers & sellers becoming a bit cautious at first its possible we could see a slow down for the next few weeks or months and with more listings coming on the market in the busy Spring season it could slow the pace of appreciation from the current 33%. A healthy market has a appreciation of 4%-7%. We have a long ways to go.

I don’t believe these measures are enough to really slow the market in the long run. If the market does slows in the coming weeks I believe by Fall/Winter we could see things start to soar again once consumers get used to the new measure. Either way this will be a interesting year in real-estate.

The Bottom Line

The Bottom Line