With the real estate market in the news almost daily and seemingly part of many conversations at social gatherings or amongst neighbours sometimes much confusion and misinformation is being shared about whats happening in the market. I’m frequently asked by my clients and friends what is happening and how we got here, so I thought I’d share some insight.

The biggest point of conversation seems to be how quickly home prices had risen earlier this year and how, just as quickly, they have now fallen and why this has happened.

First, we must understand that a “normal” increase in home appreciation in the past 20 year has been around 5%-8% growth per year. This number began to increase in the spring of 2009 after the 2008 recession when many local buyers and foreign investors quickly realized that Canada differed from the US because our banking system and our housing market was much more secure than that of the States. So after a 6-7 month drop in sales, from September 2008 to March/April 2009, people started buying homes again. Interest rates were low, first time homebuyers were confidently getting into the market. New immigrants looked at Toronto as a great place to live and raise a family and were buying homes in good school districts. Our population grew quickly.

This population growth and steady rise in demand for homes in Toronto pushed sales higher year over year. We saw the annual appreciation of homes increasing steadily over the next seven years from 5%-8% in 2009 to 10%-12% in early 2016.

Condos rose up everywhere and many would comment “we are building too may Condo’s” and “Its only a matter of time before the Condo Market Crashes”. Many buyers began to focus on Freehold Homes & they quickly became the gold standard of owning a home in Toronto.

The tipping point seems to have come late 2016 when we saw a sharp rise in the number of people wanting to take equity out of their fast appreciating homes and use that equity to purchase additional real estate. Essentially, they wanted to use the housing market like the stock market. Buy, hold, perhaps do a small renovation and then sell to make a large profit a few months or a year later. We noticed this trend continuing to grow in early 2017 and became concerned.

John Pasalis, our Broker of Record, published a report showing how speculators were driving up housing prices in the Greater Toronto Area. Here is the full report.

This type of activity started to shrink inventory as homes were bought up at a hurried pace. With a shrinking inventory and an influx of sales we rolled into spring 2017 with very low inventory and high demand along with the lowest interest rates in history to boot, you can see this was shaping up to be a recipe for a possible disaster. As inventory shrunk, prices started to rise quickly. Buyers, becoming desperate, anxious, and filled with FOMO (Fear Of Missing Out), were willing to pay 10%, 15%, and even 20% over the true value of a house because they thought they would never get into the market. Appreciation rose to a high of 33% year over year in April 2017 and the average home in the GTA (including condos) reached $920K!

At the beginning of April we were hearing that the Ontario Government was putting together a Fair Housing Plan to help cool the market. By April 20th when the measures were announced, all the agents in our Brokerage had already started seeing a slowdown. With speculators starting to disappear, foreign buyers concerned about a correction and first time homebuyers frustrated and just not able to afford to get in the market, the market stalled.

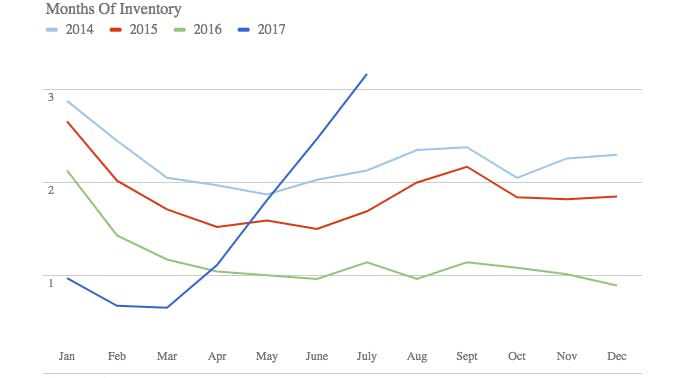

Many sellers rushed to list their homes in late April, May & June to capitalize on the record sales they saw their neighbours getting and to get ahead of a possible correction or crash. This flooded the market with inventory. To give you an idea the GTA had just under 10,000 active listings in late February. That was just under one month of inventory. In other words, if no other listings came on the market on March 1st Toronto would sell out of all homes in one month at the rate they were selling.

Sales in the GTA dropped by 37.3% in June compared with the same month last year while new listings jumped 15.9%. In late June we were almost at three months worth of inventory. A healthy market usually sits at 5-7 months worth of inventory.

With such a quick increase in inventory in less than two months and the introduction of the new Fair Housing Plan, many buyers were spooked and worried about a major housing correction. This dropped demand. At the same time, many sellers decided to continue to test the market in the hopes they could still sell their home for similar value as their neighbours who sold at the height of the market in April. For most, the high offers they hoped for have not materialized. Many have decided to take their listing off the market and possibly try again in the fall.

Months Of Inventory Has Quickly Increased Over The Last Few months.

So, where do we stand today?

We are seeing properties take longer to sell and bidding wars are far and few, although some do exist in the more established neighbourhoods in the city core. Ironically we are seeing condos stay competitive and most of the slowdown seems to have happen in freehold homes.

Homes have dropped in value by 15%-20% since April so, although they are still up in value as compared to last year, they have fallen from the crazy heights we saw at the beginning of the year. The average home price in the GTA went from a high of $920K in April to sitting around $747K today. That’s a big drop!

We are seeing less inventory/listings come onto the market the last two weeks (as of August 30th when this was published) which is normal for this time of the year.

In September, we may see a bit of a surge in listings as the sellers who took their homes off the market this summer will likely re-list This, added to sellers who had already been planning to list their homes in the fall market, may give us another increase in available inventory similar to what we saw in June. This could slow the market again.

If it does, I don’t believe a slowdown in September will be as drastic as the one we saw in May & June as the phycological effects of the Fair Housing Plan introduced in April are starting to wear off and buyers are starting to realize that this is once again a good time to buy. Added to that, the threat of higher interest rates along with homes being listed at more reasonable prices and more available choices will help many buyers to buy a bit faster to lock in better rates.

Below are a couple of articles and a helpful video from BNN featuring our President John Pasalis who explains what happened to the market and what may happen going forward.

http://www.bnn.ca/video/buyers-sellers-should-be-cautious-after-toronto-home-sales-drop-realosophy~1161667

http://www.movesmartly.com/2017/07/canadian-variable-mortgage-rates-rise-for-the-first-time-in-over-seven-years-whats-next.html

https://www.theglobeandmail.com/real-estate/toronto/is-it-a-blip-or-is-the-gta-housing-market-on-the-verge-of-correction/article35679464/?utm_source=twitter.com&utm_medium=Referrer:+Social+Network+/+Media&utm_campaign=Shared+Web+Article+Links